Insolvency can appear complicated and confusing, but it doesn’t need to be. While there are many procedures and technical terms to navigate, we aim to make your options as straightforward as possible.

The three key insolvency routes: your options

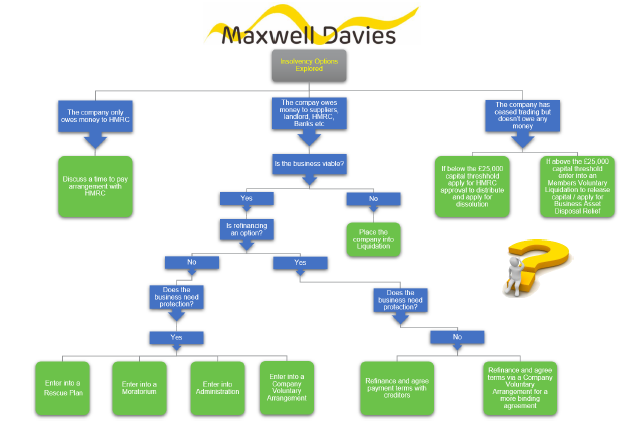

To help you understand the insolvency decision-making process, we have prepared a flowchart exploring the three insolvency routes in an easy to use, jargon-free way. It is a starting point for those business owners who are examining their next moves.

Please feel free to share with colleagues and clients who might find it useful.

One: The company only owes money to HMRC

If the main creditor is HMRC and the business does not have any other financial obligations, a time to pay arrangement may be possible. Never underestimate the seriousness of being indebted to HMRC.

While a supplier may be reluctant to chase your business for an unpaid invoice for fear of damaging client relationships, HMRC will be more tenacious and can issue a winding-up petition if you owe more than £750.

Two: The company owes money to suppliers, landlord, HRMC, Banks, etc.

A business owners route depends on whether the company is viable and if refinancing is a possible option. If the business needs protection and refinancing option is not available, an Insolvency Practitioner may suggest Rescue Plan, Moratorium, Administration or CVA procedures, depending on the business-specific circumstances.

If refinancing is agreed, and the business doesn’t need protection, a CVA offers a more binding agreement and possible protection against misfeasance claims.

Sadly, if the business is not viable, liquidation will be necessary.

Three: The company has ceased trading but doesn’t owe any money

Solvent businesses that stopped trading with a net asset position of less than £25,000 can apply for HMRC approval to distribute the capital and strike off.

If the amount is over the £25,000 capital threshold, a business should enter into an MVL. It will allow the release of capital and applying for Business Asset Disposal Relief.

Please remember that each insolvency case is different. If you would like to discuss any of the insolvency procedures in detail, please contact us for a free impartial consultation. We are here to address your concerns and creditor pressure, the risks of your position, available options and the possible outcome.