Insolvency numbers keep rising steadily, but not evenly. Does personal insolvency inequality really exist? And are women more likely to enter insolvency procedures than men?

Personal insolvencies hit the highest levels in years

In 2018 there were 115,299 recorded personal insolvencies, reaching a six year high. This was on the back of a sharp 35% increase in the last quarter, taking the overall year-on-year rise to 16%. Most alarmingly, the insolvency rate among women rose further than male insolvency for the fourth consecutive year.

As this trend continues, it’s time to look for common factors, and solutions, to specifically female financial problems.

Hurdles of female financial resilience

There are many factors which contribute to women’s financial inequality, with pay gap, lower income & childcare just to name a few.

Statistically the largest female financial impacts are connected to childbearing and the effect it has on careers and earnings. As often, in order to find more flexible working arrangements for their nuclear (or bigger) families, women are more likely than men to work on a part time in sectors and roles with lower pay. This problem is highlighted by ONS figures showing an average hourly rate for a temporary role is £9.36 compared with £14.31 for the same full-time position.

Add to this the rocketing cost of the childcare, many mothers find their return to work isn’t financially viable. With each year a mother is absent from the workplace her future wages fall by 4% (Fawcett Society).

Facing financial shocks and insolvency

Women in general face much poorer levels of pay progression than men and are much more likely to be employed on zero hours contracts. This makes women far more vulnerable to financial shocks such as a relationship breakdown, which, the insolvency trade body R3, finds is the most common cause of female insolvency. Whereas breakups are only the 8th most common cause for insolvencies for men.

Women are also more likely to be single parents, heading nine-out-of-ten single parent families in the UK. It’s understandable that these extra financial pressures can have a massive impact and often women are just one unexpected bill away from losing financial stability.

In a recent research conducted by ComRes as many as 32% of women stated that they would find it very difficult or impossible to immediately pay an unexpected bill of £100 without external assistance. And a relatively small bill or a missed payment can easily trigger a debt escalation that may soon become too difficult to juggle.

Differing personal insolvency procedures

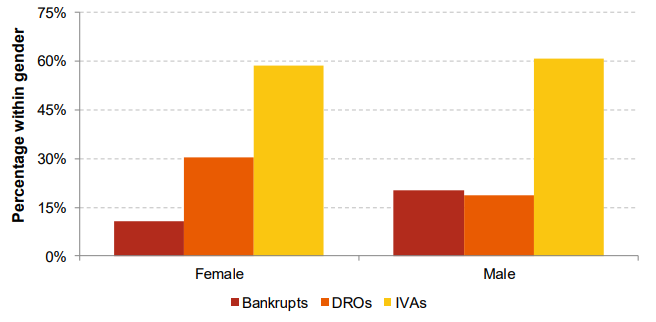

Further differences in men’s and women’s finances are also reflected in the types insolvency procedures entered.

Individual Voluntary Arrangements (IVAs)

When it comes to consumer spending related procedures, Individual Voluntary Arrangements (IVAs) were relatively equally used by men 53% and women 47% in 2017.

Bankruptcy

On the other hand, bankruptcies, usually associated with business failure, higher debt and asset levels, were made up by men in 61% of cases. As men are still more likely to run their own businesses and make more money. Meaning men are more likely the prime candidate for the bankruptcy procedures.

Debt Relief Orders (DRO’s)

The most dramatic role in increasing the number of women’s insolvencies has been played by the introduction of Debt Relief Order (DROs) in 2009. Since DROs are designed as a low-cost alternative for people with lower income, struggling with debts, women accounted for three-quarters of all DROs in 2017.

Total insolvencies by gender in 2017, England and Wales

Source: The Insolvency Service

Insolvency age-groups: who is at risk?

Personal insolvency rates remain low among young adults but are increasing for all age groups except for those aged 55 years and over. With insolvencies peaking for in the 35-44 age group.

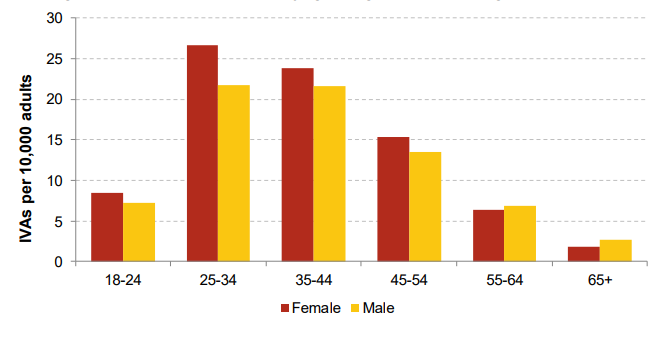

25-34 age group opts for IVA’s

However, 25-34-year-olds saw the largest year-on-year increase of 5.7%, and insolvency is now affecting 35.6 per 10,000 adults. This age group most often opted for the IVAs procedures, potentially reflecting that the rising cost of living driven in part by increased rents and limited wage increases stretching already tight budgets.

IVAs per 10,000 adults by age and gender in 2017, England and Wales

Source: The Insolvency Service

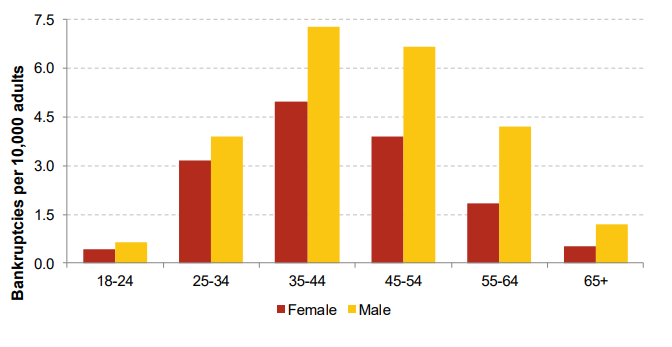

35-44-year-olds driving up bankruptcy numbers

Bankruptcy is now most common among the 35-44 years old group. As bankruptcy are usually associated with higher debts and asset levels, unsurprisingly, individuals in the age group are more likely to have assets such as homes and vehicles which could make bankruptcy the most suitable option.

Bankruptcies per 10,000 adults by age group and gender in 2017, England and Wales

Source: The Insolvency Service

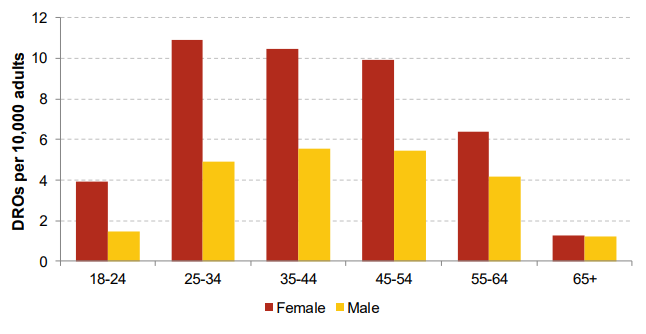

Women of all ages face more debt relief orders (DRO’s)

When it comes to DROs, women had a significantly higher rate in all age groups except for 65+ group, where the numbers were equal.

DROs per 10,000 adults by age and gender in 2017, England and Wales

Source: The Insolvency Service

How to balance the personal insolvency inequality?

Reviewing the Q4, 2018 insolvency statistics Stuart Frith, President of R3 says “It’s always important to look at the numbers for different types of insolvency procedures, as Individual Voluntary Arrangements, Debt Relief Orders, and bankruptcy numbers each tell us different things.”

While “IVAs are often used to deal with consumer debts”, DROs and bankruptcies serve better to indicate the state of the nation’s personal finances, and the rising statistics are concerning.

As the nation’s financial future remains uncertain, it remains unlikely that the overall climate will improve for any demographic in the short-term. Plus with the minimum savings levels of low-earners and with increasing numbers of zero hours contracts evermore people will be exposed to the risks of financial upsets.

With more women than men in the most at-risk groups, it means insolvency inequality shows no sign of righting itself anytime soon.

Women urged to seek debt advice sooner

Therefore, the best chance of reducing female insolvency numbers is for women to take matters into their own hands and seek debt-management advice sooner rather than later. If you are looking for a way to deal with your debts, we can help advise on various options available and the best course to take.

Seeking advice early on really can help to find the best resolution and whatever happens, we will be beside you, helping you through the process.

Please contact us so you can take first step towards resolving your situation. You don’t know what we can do until you ask.