There is no doubt the pandemic has caused substantial difficulties for many businesses. Whilst some have been able to restructure and are able to plan for the future, for others, the impact has been devastating and created enormous pressure on owners and directors.

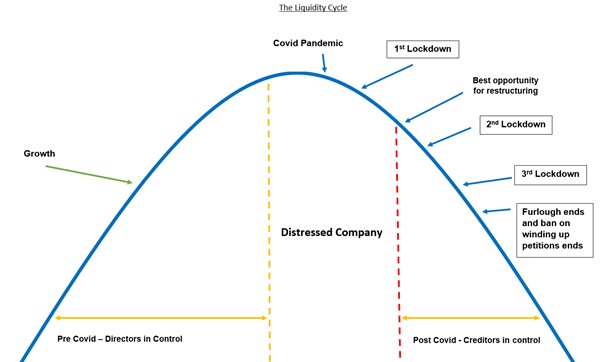

Some may have had contingency plans and reserves, but very few would have planned for a pandemic and lockdowns. Government support, such as grants, furlough, Rates and VAT relief, time to pay and rules preventing winding ups has helped, but as we start to rebuild there is a typical liquidity curve many businesses will follow:

Many businesses will face a cash flow decline and weakening balance sheet following the pandemic. As growth returns, the need to finance it, against a backdrop of supply chain difficulties, cost increases, increasing costs of employment and the difficulty in passing these on, is likely to result in a period of underperformance leading to considerable liquidity challenges. This is only likely to worsen as time passes and may well be repeated if further restrictions or lockdowns come into play.

There are many options for a business to restructure, but these reduce as you go further along the liquidity curve. Additionally, if you face insurmountable challenges, it is important for you to take control of the process at the earliest point. That is why we have prepared an Insolvency Options Flowchart exploring the three insolvency routes in an easy to use, jargon-free way.

So, if your business is struggling, seek help sooner rather than later. It is not always clear which options are the right ones for your business. The first step is to call us.

We offer a free initial confidential business rescue consultation.

If you have any questions about the insolvency process, please call our Business Rescue Service now on 0800 118 2948

You don’t know what we can do until you ask.