This question is so often the source of huge misunderstanding and upset amongst stakeholders towards the insolvency profession, who find themselves at the end of the queue for payments of their debts.

The simplest way to think of the process is in terms of a cash waterfall, emptying into a succession of pools, where the more protected creditors can scoop out enough to settle their debts before the remaining funds flow on down to the next pool.

Lets start at the top of the waterfall

All insolvency practitioners (IPs) are entitled to be paid for the work they do in a formal insolvency appointment under the Insolvency (England and Wales) Rules 2016. IPs are expert professionals in a specialist field and much of our work is mandatory compliance, with various aspects of the insolvency and other legislation which simply has no benefit to creditors whatsoever. Nevertheless, our costs are subject to scrutiny, control and approval. We routinely write off significant amounts of costs for carrying out an insolvency appointment. In addition to our fees, we have other costs such as advertising, bonds, our agents and solicitors fees, as well taxes in the estate.

Quite often at this point this is where the money waterfall ends, mainly because the assets of the company were insufficient to allow for dividend to creditors. In larger insolvencies or where investigations have led to an unexpected outcome then the prescribed order of which creditors are paid first comes into play. Who fits where in the pecking order, for which debts and why is described below.

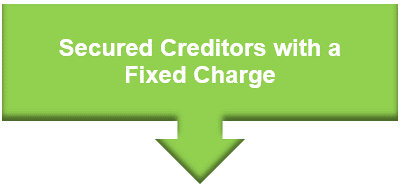

These are normally banks or other lenders, who have taken a fixed charge over individual assets, such as property, intellectual property, goodwill or in some instances, trade receivables. They get paid out first, but only out of the proceeds from selling these specific assets. Secured creditors are paid in priority to IPs fees.

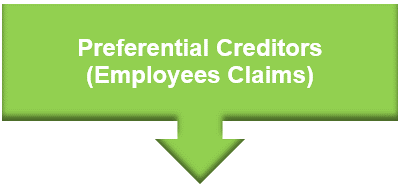

In most insolvencies, the Preferential Creditors will be employee claims for arrears of pay plus outstanding holiday pay (subject to certain limits). The rest of the claim falls into unsecured claims. There are certain other potential preferential claims such as protective awards made by an Employment Tribunal, Financial Services Compensation Scheme and environmental damage claims.

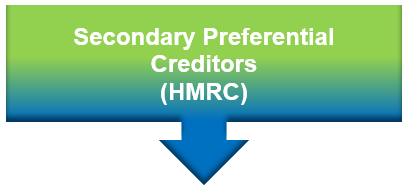

As of 1 December 2020, HMRC were given their preferential status back but only after employees have been paid. However, only certain specified HMRC debts are included (mainly taxes that a company has to collect or deduct) and these are not time limited as they used to be:

- Value Added Tax (VAT)

- Pay As You Earn (PAYE) Income Tax

- Employee National Insurance contributions (NICs)

- Student loan repayments

- Construction Industry Scheme deductions

The Enterprise Act brought in a rule that unsecured creditors should not lose out altogether, in any insolvency where there are funds left over, after Preferential and Secondary Preferential claims have been paid, but not before Floating Charge claims (see below) have been satisfied. The mechanism is to top slice from the residual funds available from floating charge assets, a percentage which is limited to a maximum of £800,000 and pay this fund to unsecured creditors.

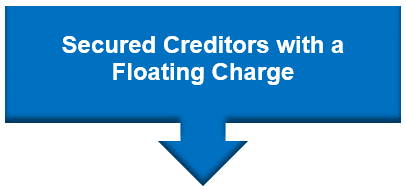

When a lender takes security, it will look for extra protection against default, by taking out a ‘Floating Charge’ over those classes of assets where it cannot take a Fixed Charge, because these assets constantly change i.e. stock. If the lender’s debt is not fully repaid out of the proceeds of Fixed Charge assets, it can then recover further funds from Floating Charge asset realisations.

Unsecured creditors covers all creditors that do not fit into any of the above categories.

They mainly cover trade suppliers, utility providers, landlords, and people who have paid in advance of a supply of goods. This category also covers employees claims for redundancy and pay in lieu of notice, although the government scheme pays these claims and stands in the shoes of the employees. Unsecured creditors interact with companies without any protection and at maximum risk should they become insolvent.

As you can you see unsecured creditors are lowest priority in terms of payment set out in legislation, if you are last in the queue then quite often there is nothing left. However, some unsecured creditors do insist on personal guarantees, whilst others quite often have terms and conditions that will have a retention of title clause, so that they can recover their goods that have not been paid for. Something for unsecured creditors to think about in order to protect themselves.

If you have any questions about the insolvency process, please call our Business Rescue Service now on 0800 118 2948

You don’t know what we can do until you ask.